Renters Insurance Coverage For Your Additional Living Expenses in Boston

Now that you’ve finally rented that amazing loft, studio or that spacious two bedroom for you and your roommate, we’re pretty sure you’re not focused on what will happen if it gets destroyed or becomes unlivable. That’s depressing stuff to think about, so why would you? We are also fairly certain you’re not rushing to make an appointment with your insurance agent to discuss worst-case scenarios and renters insurance additional living expense coverage. Again, Lighthouse understands; you’re in a fantastic city, and there are way too many juice bars, spin classes, restaurants and live music venues to check out.

But at the risk of sounding like your mother, we are going to do our best to educate you on why you should be thinking about what would happen if you had to move out of your apartment temporarily and how you would pay for that. We suggest that spending a little QT with a Lighthouse insurance agent today will actually help you feel more relaxed in your apartment and less stressed when out and about.

Here’s three reasons why you should invest in Renters Insurance in Boston with Additional Living Expense Coverage:

- Tragedies are not as rare as they may seem. As an example, according to the National Fire Protection Association, every 23 seconds, a fire department responds to a fire somewhere in the United States and a home fire occurs every 85 seconds. We humans, for some reason, seem to ignore these types of facts and instead share the same common misconception: those things happen to other people, but not me. Reality is of course that bad things can happen to any one of us at anytime. And the only way to relieve any related angst or fears is to properly protect yourself with comprehensive renters insurance.

- Moving back in with your family or crashing on a friends couch can be avoided. In the event your apartment is destroyed by a catastrophe such as fire or smoke, windstorm, flood, or explosion, you are clearly going to need to live somewhere else. Maybe you have a kind relative or friend in the area that will take you in, but maybe you don’t. Either way, imposing on someone else doesn’t have to be your only option. In fact, properly designed renters insurance will provide additional living expense coverage that could pay for hotel bills or temporary rentals, restaurant meals and other expenses you incur while your apartment is being repaired or rebuilt.

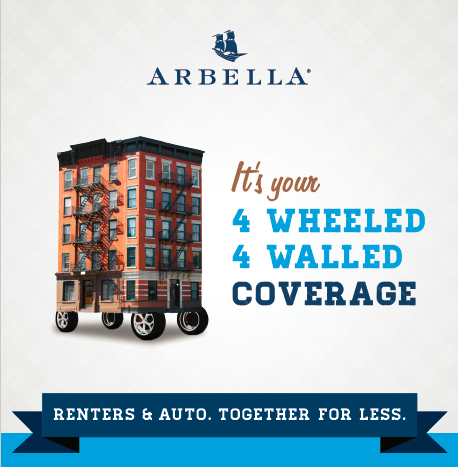

- You probably don’t have to lift a finger to qualify for discounts on your renters insurance. Do you own a car? Have a security system? Use a smoke detector or deadbolts? Any of these may qualify you for discounts with a number of the top insurance carriers we work with. Even better, the only thing you need to do to access these money-saving options is put your confidence in us to find the best coverage and deal for you.

Lighthouse Insurance Additional Living Expense Coverage

You’ve worked hard for the independence that having your own apartment provides. Make sure you don’t have to compromise this accomplishment. With a minimal investment – as low as $12-20 a month – a renters insurance policy with additional living expense coverage can keep you living a care free life.

You’ve worked hard for the independence that having your own apartment provides. Make sure you don’t have to compromise this accomplishment, with a minimal investment – as low as $12-20 a month – renters insurance with additional living expense coverage can keep you living a care free life.

Call Lighthouse Insurance today at 617-464-3777 to get a free quote for renters insurance. Your parents will be proud.